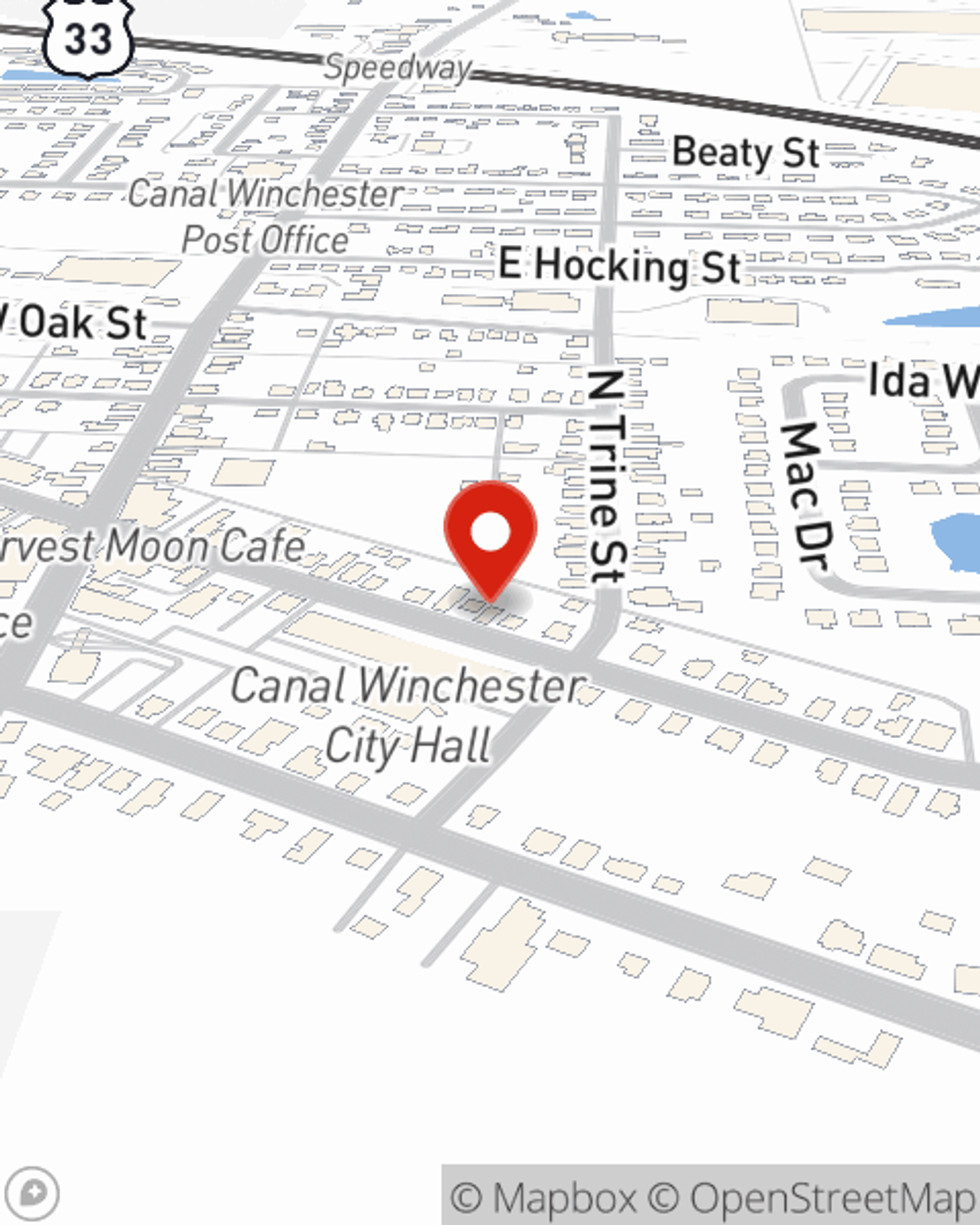

Business Insurance in and around Canal Winchester

Looking for small business insurance coverage?

Helping insure businesses can be the neighborly thing to do

Help Prepare Your Business For The Unexpected.

It takes courage to start your own business, and it also takes courage to admit when you might need support. State Farm is here to help with your business insurance needs. With options like a surety or fidelity bond, errors and omissions liability and worker's compensation for your employees, you can feel confident that your small business is properly protected.

Looking for small business insurance coverage?

Helping insure businesses can be the neighborly thing to do

Cover Your Business Assets

When you've put so much personal interest in a small business like yours, whether it's a sign painting company, a beauty salon, or a bakery, having the right coverage for you is important. As a business owner, as well, State Farm agent Tom Parker understands and is happy to offer personalized insurance options to fit your business.

Agent Tom Parker is here to talk through your business insurance options with you. Contact Tom Parker today!

Simple Insights®

Employer-owned life insurance

Employer-owned life insurance

Find out about employer-owned life insurance policies and how they might play a vital role in the financial life of a business.

The landlord's guide to the eviction process

The landlord's guide to the eviction process

Evictions can be a lengthy, daunting process for landlords and tenants, so it’s important for you to be aware of the specific reasons, procedures and costs.

Tom Parker

State Farm® Insurance AgentSimple Insights®

Employer-owned life insurance

Employer-owned life insurance

Find out about employer-owned life insurance policies and how they might play a vital role in the financial life of a business.

The landlord's guide to the eviction process

The landlord's guide to the eviction process

Evictions can be a lengthy, daunting process for landlords and tenants, so it’s important for you to be aware of the specific reasons, procedures and costs.